GCSE Business Studies 0450

Business Studies – Financial Decisions

- Selecting Appropriate Sources of Finance

- Cash flow forecasting and Working Capital

- Income Statement (Profit or Loss) and Balance Sheets (Assets and Liabilities)

- Analysis of Business Accounts

Sources of finance

Internal sources of finance are money raised from within the business. Internal sources are the assets (current and non-current) or profit left in the business (retained profit).

External sources of finance are money raised from outside the business such as bank loans or investments from shareholders.

Retained profit is money kept in the business by the owners. Keeping the profit in the business is a good way to grow the business. There is no need to pay interest on the money. Another advantage is that retained profit is instantly available (allowing the business to grow).

A disadvantage of using retained is that the business may not have enough retained profit to meet its needs. Using the retained profit may also result in shareholders receiving lower dividend payments.

Assets owned by the business are sold and the money is used to finance the business. An advantage of selling assets is that the business is using money it already has, so there is no need to take on loans or pay any interest or charges. Selling assets will increase the liquidity of the business as money is not tied up in non-current assets (machines no longer needed).

One potential disadvantage is that the business may end up selling an asset needed at a later date. The business also must have assets that are worth selling.

Short-term sources of finance are money needed for a short period, usually within one year.

Long-term sources of finance are used when money is required for more than one year.

External sources of finance

For paper two case study questions, provide context by analysing the appropriate source of finance. A Sole Trader will not have the same options to raise finance as a Public Limited company. Shareholders buying shares is a form of external finance. This is because companies have a separate legal identity and therefore shareholders provide external finance and are not liable for the debts of the business.

An amount of money borrowed from the bank, then repaid (with interest) over a set period. Bank loans can provide a large amount of money and repayments on the loan can be made over a long period.

Interest will need to be paid on the loan (interest rates can go up). If repayments cannot be kept up, the business risks getting a poor credit rating or being made bankrupt

Money is put into the business by the owner, usually from personal savings. There is no need to pay interest. The disadvantage is that an owner may not have enough money to meet the needs of the business.

Long-term loan provided by a bank to buy property. Mortgages are paid back with structured repayments over a long term (25 years). A mortgage becomes a non-current liability. The disadvantage of a business taking out a mortgage is that large sums of interest can be charged. It can take a long time to repay debt (non-current liabilities increase)

Trade Credit is when items are bought from suppliers on a ‘buy now pay later’ basis. Often businesses can arrange agreements to pay for (stock) 30 or 60 days later. Trade Credit can free up additional money in the business to use by delaying payments. A business will need a good credit rating and relationship with suppliers to use trade credit.

Hire purchase is when items are bought on finance, and repayments are made each month until the final payment when the item becomes the property of the business.

One advantage is that it’s a flexible method as the business can hand back the item if no longer required and payments will stop. However, high interest is often charged and the item doesn’t belong to the business until the end of the term.

Venture capitalists invest in small, risky businesses e.g. new business start-ups. A good example of businesses raising venture capital is ‘Dragon’s Den’. One advantage of venture capital is that money can be raised when banks have refused to lend to the business.

A disadvantage is that venture capitalists may want to have some control over how the business operates

Microfinance provides small sums of capital to entrepreneurs who may not be able to get bank loans. Microfinance is usually popular in low-income or developing countries.

Crowdfunding is usually done online where a large number of people provide small amounts of money to fund a new business venture.

The company sells a debt it is owed to a debt factoring company which pays the business a smaller sum than they were owed.

Allows the business to get money for debts that might otherwise never have been paid. Saves the business time chasing customers for money owed. By using debt factoring a business receives less money than it was originally owed and this may affect profitability.

Leasing can be used to help obtain new equipment. The business rents the item from its owner. Another option is to sell the item or equipment and then lease it back. This is known as a sale and leaseback.

The cost of the asset is spread over its life. No need to find a lump sum of money to purchase it. Leasing may be more expensive than buying the asset because the owner will want to profit from the deal. The business does not own the asset so it does not appear on the balance sheet.

Debentures are long-term borrowing similar to selling shares but with the promise of repaying the amount lent over a fixed period, usually for a set amount of interest. Structured method which allows the business to know exactly how much interest will be paid and when the debt has to be paid back.

Debentures are ‘secured’ against assets of the business such as property, if the interest on the debt, or the debt itself isn’t repaid, the debenture holder will claim the property. No longer a popular method of finance for businesses

A share in the business is sold to an individual or another business. This money is known as share capital and can then be used to purchase new assets or expand the business.

- No need to repay the money invested by shareholders

- Cheaper than a loan as there is no interest to be paid

- Some businesses can raise large sums of money this way

- Need to pay the shareholders a share of future profits

- Ownership also means some influence over how the business is run – the original owners may lose control of the business

- Risky for the shareholder – the investment may be lost if the business fails

The bank allows the business to draw more money from their bank account than they have available.

- Quick to arrange

- A good short-term solution to a cash flow problem

- Only suitable for smaller amounts and has to be repaid within a short amount of time

- Interest or charges are paid

Money is given to the business by the government. Grants can be used to help finance new projects – especially those that create new jobs in underdeveloped areas within a country.

- No need to pay interest

- No need to repay the grant

- Limited funds are available

- There may be restrictions on what the money can be used for.

Start-up capital is the money needed by an entrepreneur to set up a business.

Cash-flow forecasts

Cash is a liquid asset, meaning that it is immediately available for spending on goods and services. A business needs cash to keep it running.

Net cash flow is the difference between inflows and outflows.

The closing balance is the money left at the end of each month.

The opening balance is the money available at the start of the month. Remember that the opening balance is taken from the previous month’s closing balance.

Working Capital is the money available to pay the short-term debts of the business. Working Capital is money used to pay for the day-to-day running of the business. This includes salaries for employees and payments to suppliers for stock. Without Working Capital a business will fail.

Effects of cash-flow problems

- Unable to pay workers, suppliers and landlords

- Production of goods and services will stop

- The business may be forced into ‘liquidation’.

Common cash inflows

- The sale of products for cash.

- Payments made by debtors – customers ‘buy now pay later’

- Borrowing money from an external source

- The sale of assets, e.g. unwanted property

- Investors – e.g. shareholders

Common cash outflows

- Purchasing goods or materials for cash

- Paying wages, salaries and other expenses

- Purchasing fixed assets

- Repaying loans

- Paying creditors of the business (Suppliers)

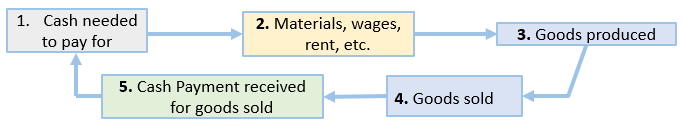

Cash-flow cycle

The cash-flow cycle illustrates the need for managers to plan for their cash needs so that the business is not put at risk of running out of cash.

Improving cash-flow

- Agree on an overdraft or increase an existing overdraft

- Extend the length of time taken to pay suppliers

- Reduce the price of some products to get quick sales

- Sell to customers for cash rather than offer trade credit

- Sell some equipment

- Reduce stock levels

- Buy cheaper raw materials

- Allow debtors discounts for early payment

- Operate tighter customer credit controls

- Use debt factoring

.

.

Effects of cash-flow problems

- Unable to pay workers, suppliers and landlords

- Production of goods and services will stop

- The business may be forced into ‘liquidation’.

Income Statements

The income statement is also called the profit and loss account. This is part of the legal documents that must be published each year by a Private Limited Company (Ltd) or Public Limited Company (Plc). The income statement shows if the business has made a profit or a loss during the year.

Revenue (Sales)

Revenue is money received into the business through sales. It is also known as turnover or income. To calculate revenue we can use quantity sold x price. For example, if a business sells 100 Pizzas at £12 each the revenue will be 100 x £12 = £1,200.

Revenue = Price × Quantity Sold

Cost of sales

Cost of sales is the cost of selling the product or services provided by the business to generate sales. Therefore, the cost of sales will be directly linked to the amount of sales the business makes. The cost of sales is a variable cost which includes raw materials and inputs used to produce the product or service. The cost of sales will also include the packaging and wages for part-time employees.

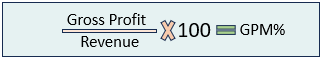

Gross Profit

Gross Profit = Revenue – Cost of Sales

Gross profit is used by the business’s managers, owners and investors to measure success and efficiency. The higher the gross profit margin the more gross profit will be made for each sale.

Expenses

Net Profit is used by potential investors of the business to see how hard their money would work if it was invested into the business. Net profit is the money left after all expenses and taxes are paid. Net profit (Operating Profit) is often called the bottom line because it is usually the last line on the income statement.

Example Income Statement

The following is an example of a basic income statement. Often exams at the GCSE level will ask you to calculate missing values. Remember that figures in (are negative). Net profit will always be less than gross profit.

Try and practice calculating the following for a local business

- Revenue

- Gross Profit

- Expenses

- Net Profit

Wages are a variable cost as the business will need to pay more to part-time employees to produce more profits. Full-time employees are paid a fixed salary each month (Fixed Cost). No matter how many products the full-time employees produce in one month they will be paid the same.

Net Profit (Operating Profit)

Net Profit = Gross Profit – Expenses

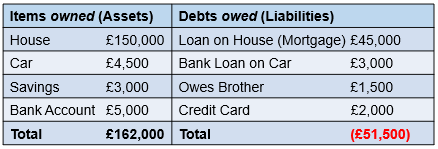

Balance Sheets

Current and non-current

Current Assets are items owned by the business and used (sold) within one year.

Non-current assets are items owned by the business that have value but will not be sold for more than one year.

Current Liabilities are the short-term debts owed by the business that must be paid within this financial year. Non-current liabilities are the long-term debts owed by the business such as a bank loan.

Balance Sheets show the value of a business’s assets and liabilities at a particular time (snapshot). Sometimes referred to as a ‘statement of financial position’.

Assets are items of value which are owned by the business. They may be fixed (non-current) or short-term (current assets). Liabilities are debts owned by the business.

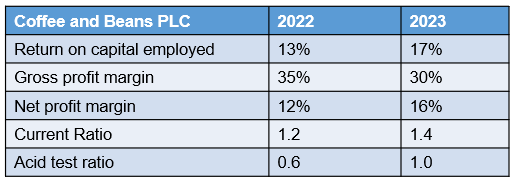

Analysis of Business Accounts

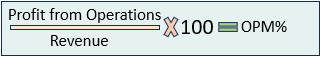

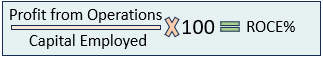

Use the following formulas to calculate profit margins.

Calculating the Return on Capital Employed

GCSE Business Studies Operations Management Exam Practice.

GCSE Business Studies Revision Videos

Business Activity

Coming soon…

Types of business

Coming soon…

Exam Practice for Paper One

Coming soon…

Access additional Business Studies resources

Complete our contact form and let us know what topics you would like to improve.